Corporations publicly announced a record 46 gigawatts (GW) of solar and wind contracts in 2023, some 12% more than the previous record of 41GW in 2022. The improving economics in key regions like Europe, alongside imminent company clean energy goals, were the main drivers underpinning this growth and position the market even better for 2024, finds BloombergNEF (BNEF) in its 1H 2024 Corporate Energy Market Outlook.

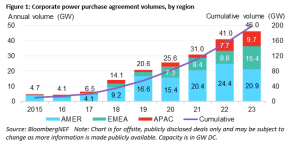

According to BNEF, since 2008, corporations have announced power purchase agreements, or PPAs, for 198GW of solar and wind – greater than the power generation capacity of countries like France, the United Kingdom and South Korea. The PPA market has grown 33% on average since 2015 and catalyzed hundreds of billions of dollars of investment into the energy transition, marking the seventh year that the corporate PPA market has reached a new high.

Kyle Harrison, Head of Sustainability Research at BloombergNEF and lead author of the report said, “It has never been easier to buy clean energy as a corporation. For the first time, a variety of contracting structures are now widely available around the world to help companies decarbonize their energy consumption. These contracts are now the centerpiece in many companies’ sustainability strategies, rather than a nice-to-have.”

Some 45% (20.9GW) of corporate PPAs announced in 2023 were in the Americas region, followed by Europe at 33% (15.4GW). Between 2022 and 2023, Europe saw its corporate PPA volumes grow 74% to 15.4GW – by far the largest growth of any region. As supply chain woes eased and gas balances normalized following the region’s energy crisis in 2022, corporate PPA prices in the region dropped, often faster than power prices. As a result, the economics for signing deals were much more attractive in European markets like Spain, Germany, the United Kingdom and the Netherlands. Collectively, these four countries made up over half of the deals announced in the region in 2023.

While the United States remained the largest market for PPAs, with 17.3GW of deals announced, this was down 16% from the record 20.6GW announced in 2022. Contrary to Europe, the economics for signing PPAs were far weaker in the US. Developers were locked into expensive equipment contracts signed in prior years during supply chain bottlenecks. Coupled with high interest rates, this caused US PPA prices to increase 4% in the first half of 2023. Power prices didn’t rise at the same rates, resulting in buyers holding off on signing deals until the market recalibrates.

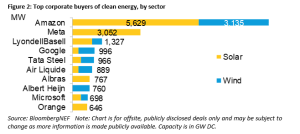

For the fourth year straight, Amazon was the world’s largest corporate clean energy buyer among a group of over 200 companies tracked by BNEF, followed by Meta, LyondellBasell and Google. In 2023, Amazon announced 8.8GW of PPAs across 16 countries. The company’s clean energy portfolio totals 33.6GW, which is greater in size than the power generation fleets of markets like Belgium and Chile. BNEF estimates that companies with 100% clean energy targets as part of the RE100 initiative will need an additional 105GW of solar and wind by 2030. This number is far larger when looking at all companies.

“With the rise of artificial intelligence, electrification of transport and increased need for manufacturing, we expect power demand from the private sector to surge in the coming years”, said Harrison. “Clean energy, especially through PPAs, will likely be many companies’ first, best option.”

Overall, companies signed deals with over 150 developer counterparties in 2023. French utility provider Engie sold the most clean energy to corporations through PPAs last year (2.4GW of deals). This is the first time Engie has topped the leader boards since 2019, when it sold 1.3GW of solar and wind to corporations. It was also the only major developer to sign a solar, onshore and offshore wind corporate PPA in 2023. Following Engie was AES, which announced 1.9GW of deals and was the top developer for the two previous years. Tata Power (1.2GW), Lightsource BP (1GW) and Eneco (0.9GW) rounded out the top five developers in 2023 and selling to corporations will continue to be a key strategy for them.

BNEF updates its data on corporate procurement each month and publishes a market outlook on corporate energy strategy bi-annually.