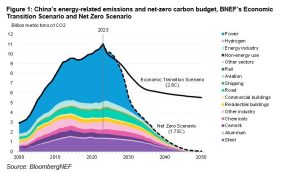

BloombergNEF’s New Energy Outlook: China illustrates how the country could accelerate its decarbonization journey. By achieving net-zero emissions a decade earlier than its current 2060 target, China—the world’s largest emitter—could play a pivotal role in enabling the world to meet the Paris Agreement goal: keeping global warming well below two degrees Celsius and averting the worst impacts of climate change. The report emphasizes that scaling up clean technologies for hard-to-abate sectors is crucial for this accelerated transition.

The New Energy Outlook: China, published today by research provider BloombergNEF (BNEF), presents two updated climate scenarios: the Net Zero Scenario (NZS) and the base case Economic Transition Scenario (ETS). These scenarios are designed to inform public policymaking, guide national climate ambitions, and support the low-carbon transition strategies of corporations and financial institutions.

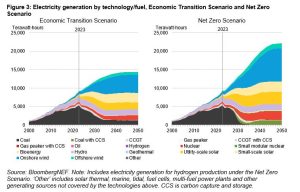

The report’s Net Zero Scenario, consistent with a 67% chance of limiting global warming to 1.75 degrees Celsius, requires that demand for oil, gas, and coal peaked last year and enters a steep decline starting in 2024. Emissions must fall across all sectors, with the power and transport sectors leading in abatement speed, followed by buildings and industry. The rapid scale-up of renewable energy capacity within this decade accounts for most of the short-term changes. Electric vehicles (EVs) are another key technology, with their market share in the vehicle fleet to reach 65% by 2030 and 95% by 2040. Additionally, the active deployment of carbon capture technologies, along with energy storage and nuclear power before 2030, is essential for continued abatement in the following decades.

“The path to staying well below two degrees is narrowing,” said Nannan Kou, China decarbonization specialist at BNEF and the lead author of this report. “Since our last update in 2023, China has been the largest country in terms of new renewable energy installations and electric vehicle adoption. But the country could do even better. This report should serve as a bugle call for China’s low-carbon transition, proposing more ambitious targets to unlock potential and accelerate the transformation.”

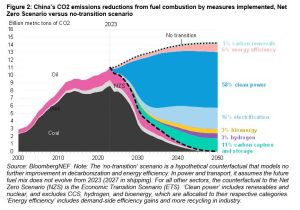

Decarbonizing China’s power sector accounts for 58% of emissions avoided between today and 2050, compared to a no-transition scenario where no further action is taken on decarbonization. Electrification of end-use sectors, including road transport, buildings, and industry, contributes to 16% of emissions reductions in China. Efficiency improvements also play a crucial role. The solutions needed to abate China’s remaining 20% of emissions are among the most challenging to scale: carbon capture and storage in industry and power, biofuels in shipping and aviation, and hydrogen in industry and transport.

The New Energy Outlook: China also details a base case ETS, where clean-energy technologies are deployed only when they are economically cost-competitive or adopted by consumer choice, with no additional policy support for clean technologies. Wind and solar are already commercially competitive in China, leading to their rapid growth under this scenario. Under ETS, solar and wind account for 52% of China’s power generation by 2030 and 70% by 2050. China is already building an electric power system that is increasingly adaptive to the intermittent and non-dispatchable nature of wind and solar.

“China is actively deploying pumped hydro and battery storage, key components of its new electric power system, which is designed for high renewable energy penetration,” said Sisi Tang, manager of China research at BNEF. “At the same time, demand-side flexibility is another crucial element. Regulatory changes and new market mechanisms have been introduced to enhance demand-side response and smart electric vehicle charging. These efforts will enable the new power system to rely more on cost-effective renewable energy sources.”

EV uptake is making significant progress under ETS, primarily because EVs are increasingly cost-competitive with internal combustion engine vehicles. The development of more appealing EV models and the rapid expansion of charging networks are also crucial for their growth in China. Together, clean power, EVs, and efficiency improvements help reduce 2050 emissions under the base-case ETS by 60% compared to what they would be without these technologies, or 50% below current levels. While this is only halfway to net-zero, it highlights the potential of an energy transition based solely on economically and commercially viable technologies. In this scenario, fossil fuels remain in the energy system due to the lack of incentive to replace their use in hard-to-abate sectors. Gas demand is expected to grow from 2023 levels, oil remains nearly constant, and coal consumption declines the most.

Leo Wang, head of China research at BNEF, said, “Renewable energy, electric vehicles, and energy storage are the fastest-growing clean technologies in China. They are either already in or will soon enter their rapid expansion phase, requiring no additional policy support. These technologies will help China reduce emissions and enhance energy security, while also serving as new engines for the country’s economic development.”

China’s current nationally determined contribution (NDC) calls for lowering its CO2 emissions per unit of gross domestic product (GDP) by over 65% from the 2005 level. Both BNEF’s ETS and NZS result in China’s 2030 emissions being lower than its NDC level in 2030. Instead, the NZS results suggest that, for China to stay on track with the Paris Agreement goal, it needs to target at least a 43% reduction in energy-related emissions by 2035, compared to 2005, for its next NDC. The next round of NDCs are due for submission to the United Nations Framework Convention on Climate Change by early 2025.

The report also highlights other important aspects of China’s decarbonization process, including:

•The need to scale up key technologies for emission abatement to stay on track for net zero, particularly those not yet commercially available, such as carbon capture and storage, hydrogen, and sustainable aviation fuels.

•An updated understanding of where low-carbon hydrogen can play a vital role in China and where electrification and carbon capture and storage are better solutions.

•How these technologies interact with each other and collectively decarbonize different sectors.

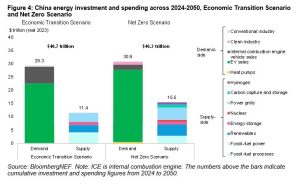

•The investment volumes required to achieve the ETS ($40.7 trillion by 2050) and the NZS ($46.3 trillion by 2050), when most of the investment will occur, and why the difference between the two scenarios is only 14%.

This research forms part of a series of regional and sector reports diving deeper into results from BloombergNEF’s global New Energy Outlook report for Europe, Australia, the US, Japan, and India over the coming months.