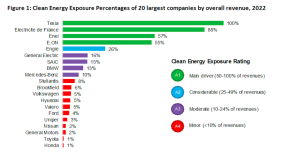

In 2022, clean energy activities generated at least $2.56 trillion globally, according to the Clean Energy Exposure Ratings analysis published by BloombergNEF (BNEF). This includes company revenues drawn from clean energy production, and from the manufacturing of key technologies and equipment for clean energy[1].

BNEF’s Clean Energy Exposure Ratings provide investors with transparency about their exposure to the opportunities of the low-carbon transition. They identify and rate 8,182 listed companies with revenue exposure to clean energy activities, from over 50,000 assessed. Just 2,780 explicitly disclose relevant revenue, giving them a precise percentage exposure value. BNEF data[2] and analyst expertise is used to identify the remaining 5,402 and rate them from A1, for those that draw over half of their revenues from clean energy, to A4, where this is lower than 10%.

Listed electric utilities like EDF, Enel and E.ON accounted for $1.06 trillion (42% of the total) in clean energy revenues, followed by renewable energy manufacturers and developers including CATL, Vestas, Trina Solar, contributing $628 billion (25%) in clean energy revenues in 2022.

“While automakers like Volkswagen and Toyota are among the biggest earners in the rankings, their exposure remains low and so the auto industry only contributes $370 billion to the total,” said Mike Daly, lead author of the report.

Source: BloombergNEF, Bloomberg Terminal, company reports. Note: excludes high-revenue companies that don’t explicitly disclose clean energy revenue.

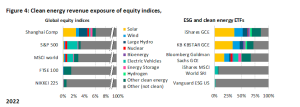

The analysis finds that top global equity indices display very low exposures to clean energy revenues. For example, only 3.4% of portfolio-weighted revenues in the S&P 500 are exposed to clean energy. For the MSCI World Index, it is 3.0% (Figure 4). This analysis also shows that the clean energy revenue exposure of the most popular ESG exchange-traded funds (ETFs) remains marginal. However more targeted equity ETFs, such as the iShares Global Clean Energy ETF (86% exposure, A1), the KBSTAR Global Clean Energy ETF (72%, A1) or the Goldman Sachs Bloomberg Clean Energy ETF (68%, A1) achieve higher clean energy exposures (Figure 4).

Source: BloombergNEF Clean Energy Exposure Ratings. Note: GCE stands for Global Clean Energy. This analysis draws from BNEF’s Clean Energy Exposure Portfolio Tool.

[1]. The scope of coverage includes solar, wind, hydro, nuclear, power grids, electrified transport, energy storage, hydrogen, geothermal, bioenergy and carbon capture.

[2]. This includes, for example, electric vehicles sales data for automakers or clean energy power generation and capacity data for electric utilities.