Japan’s transition to a net-zero economy by 2050 presents an investment opportunity that amounts to at least $6.7 trillion, according to the New Energy Outlook: Japan report, published recently by research company BloombergNEF (BNEF). The report details two scenarios for Japan’s energy system and the implications of the country’s transition opportunities and challenges. The base case Economic Transition Scenario describes an economics-led transition, consistent with a global temperature rise of 2.6°C by 2100. The second, the Net Zero Scenario, is consistent with net-zero emissions by 2050 with no overshoot or reliance on unproven technologies.

Successful power sector decarbonization key to unlock Japan’s transition

Power generation is the largest source of emissions in Japan. The country lags behind its G-7 peers on clean power generation due to a slowdown in renewable capacity additions, as well as delays in restarting nuclear power plants. BNEF’s analysis finds that maximizing deployment of solar and wind, supplemented by additions of energy storage and carbon capture and storage (CCS) for thermal power plants, along with restart of existing nuclear power plants, is the cheapest way for Japan to decarbonize its power supply. Japan can also tap into its abundant geothermal potential.

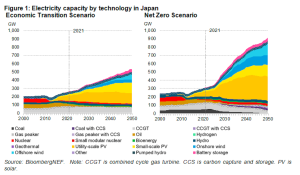

In BNEF’s Net Zero Scenario (NZS), which charts a pathway for Japan to reach net zero by 2050 while keeping global temperature rise well below 2 degrees Celsius, the total installed capacity of wind and solar power reaches 689 gigawatts by 2050, more than eight times the 81 gigawatts as of 2021. Wind and solar generation together account for 79% of electricity supplied under NZS in 2050, while nuclear provides 11%. The rest of demand is met by hydro, geothermal and thermal power plants equipped with CCS. Even under the Economic Transition Scenario (ETS), BNEF’s baseline scenario, least-cost power system modelling shows solar and wind still become the dominant source of electricity supply, accounting for 62% of electricity generated in 2050.

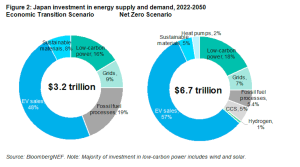

Under the ETS, investment in energy supply and demand reaches $3.2 trillion over 2022-2050, or an annual average of $115 billion. To stay on track for net zero, according to BNEF’s NZS, Japan would need to more than double the rate of investment during the same period, for an annual average of $239 billion, or about 3.8% of expected gross domestic product. Total investment in fossil-fuel power drops from $609 billion in the ETS to $359 billion in the NZS. To abate emissions from the remaining use of fossil fuels in the NZS, Japan needs $315 billion in investment for CCS. Electric vehicle sales account for the largest share of investment for energy demand in both scenarios. In the NZS, $3.8 trillion is spent deploying EVs.

Japan can reduce its emissions while strengthening its energy security

“Japan spent $1.8 trillion on fossil fuel imports over 2010-2022, equivalent to an annual average spending of more than 3% of GDP,” said David Kang, Head of Japan and Korea Research at BNEF. “If Japan can redirect some of this expenditure toward deployment of mature clean technologies such as solar, wind and electric vehicles, it would create more domestic economic opportunities while reducing emissions and strengthening its energy security.”

Japan needs to accelerate deployment of mature renewable technologies and reform its generous yet inefficient hydrogen subsidies

To accelerate its energy transition, Japan needs to reduce the hurdles renewable developers face by increasing the transparency of grid connection processes, as well as shortening and simplifying permitting processes. Deployment of renewables can also be accelerated by organizing local government-led reverse auctions with guaranteed access to land (or the seabed in the case offshore wind) and grid connections.

“Fossil-fuel power generation accounts for more than 70% of Japan’s electricity generation today,” said Isshu Kikuma, Japan Senior Associate at BNEF. “Instead of pursuing costly unproven approaches such as retrofitting existing coal power plants for co-firing with ammonia, Japan would be better served accelerating the deployment of geothermal, solar and wind.”

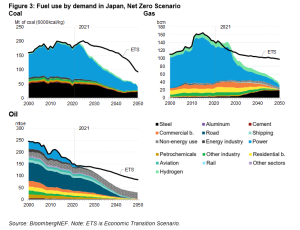

Japan’s past hydrogen policies have provided generous subsidies for applications such as fuel cell passenger vehicles, as well as residential fuel cell co-generation systems. However, there are cheaper and more effective ways to decarbonize passenger vehicles as well as residential buildings. While the Japanese government’s 2050 target calls for annual hydrogen demand of 20 million tons, BNEF’s NZS requires just over 7 million tons of hydrogen.

“As Japan’s supply of clean hydrogen will be limited due to its geography, the government should prioritize sectors where clean hydrogen will be the most effective decarbonization pathway,” said Toshiya Shinagawa, Japan Associate at BNEF. “Japan will likely need to rely more on CCS compared to hydrogen for heavy-industry decarbonization, but its current carbon tax on fossil fuels – ¥289 ($2) per ton of CO2 – is too low to attract investment in CCS.”

This research forms part of a series of regional and sector reports diving deeper into results from BloombergNEF’s global New Energy Outlook, including reports for Europe, Australia, China, Japan, the US and India. Report summaries are available at about.bnef.com/new-energy-outlook-series.