|

WARC, the global authority on marketing effectiveness, and Spotify Advertising, the advertising arm of Spotify, the world’s most popular audio streaming service, have today released a new report exploring how digital audio channels are being adopted within the media mix of European telecommunication brands. The study shows the current state of play for European telecom marketing and unearths untapped digital audio opportunities as these brands strive to drive greater marketing effectiveness. For the report, WARC surveyed more than 360 telco marketers from France, Germany, Italy, Spain and the United Kingdom to better understand their objectives, media spend, performance and perceptions of audio channels. Additionally, WARC conducted a series of in-depth interviews with European telco marketers and industry experts. The data and research was combined and reviewed alongside WARC’s global media data, industry knowledge and case studies. Aditya Kishore, Insight Director, WARC, said: “Telcos are in danger of being overshadowed by faster, more agile, slicker digital media and consumer tech brands. Increasingly, it is these digital brands that are being seen as leaders and innovators by businesses and consumers alike. “However, savvy telco marketers are responding. To enhance the effectiveness of messaging and propositions, they are improving the customer experience, investing more into digital channels and looking for opportunities to learn more about their customers. Digital audio is an important component that telcos are increasingly considering as part of the channel mix, since it offers some distinctive opportunities for engagement, insight and personalisation.” Samuel Fermont, Tech and Telco Category Development Officer, EMEA, Spotify, commented: “This report shows the opportunity for telcos within the digital audio space. Listeners engage with Spotify to experience inspiration and discovery, enabling telco marketers to reach consumers when they’re in a highly engaged mindset. As digital audio consumption continues to rise around the world, now is the time for telco marketers to invest in digital audio advertising.” Key takeaways are:

The last 15 years have seen a large-scale transfer of value from telcos to device manufacturers and content platforms. To reverse the trend, telcos are seeking to reposition as techcos. This necessitates developing ‘beyond connectivity’ solutions that address specific customer pain-points across B2C and B2B segments. Maria Koutsoudakis, Brand and Marketing Director, Vodafone, says: “The shape of the market has changed. I believe telecommunication has been a flat, predictable industry. However, the pandemic has changed its rhythm and routine… There’s less market predictability so now we have to ensure agility.”

90% of European telcos have evolved their communications strategy over the last five years. The importance of brand building is recognised, but performance marketing appears to be a higher priority. Telcos are strongly concentrated on new channels, first party data and more personalised experiences; but still experiencing targeting and impact challenges. Brad MacDonald, Head of Digital Performance, Mobile, Virgin Media O2, says: “If we need to achieve X number of orders within a quarter, we then go through the process of working out what the cost per order will be. This definitely skews some of the thinking towards areas we can track more reliably. Social is a good example. There are certain social platforms that are further advanced in terms of how they work with us and the data we can get back. Therefore, we spend a bit more in those areas.”

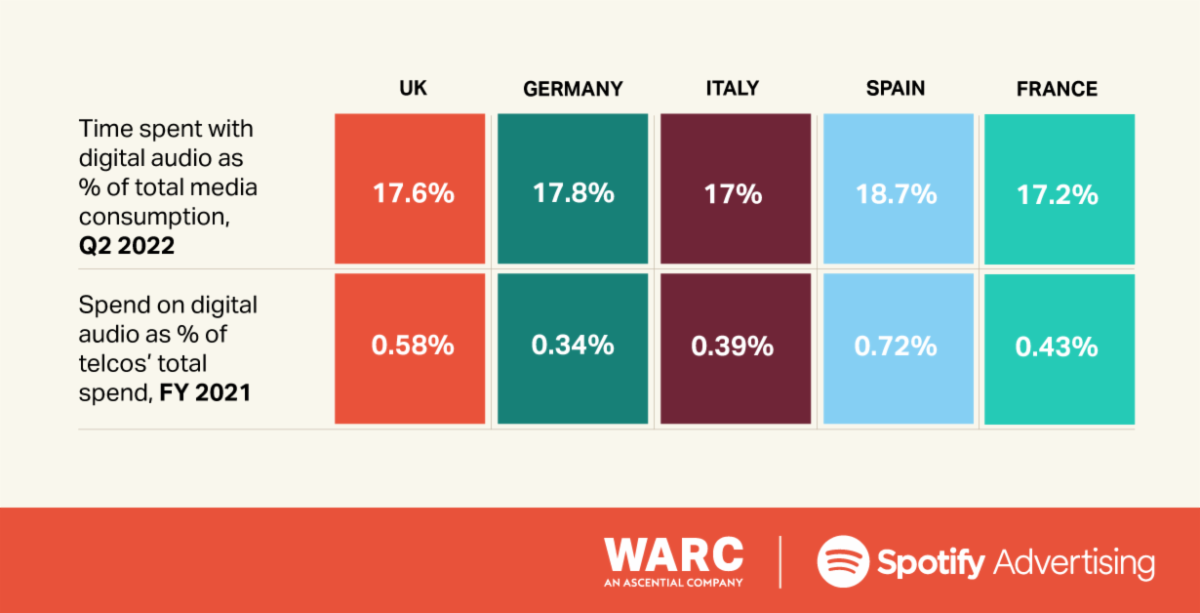

In contrast to the Technology & Electronics sector, telcos’ share of voice across Europe has fallen significantly since 2013. At the same time, spend has skewed towards shorter-term performance channels. Consumption of digital audio is growing fast but there is a significant investment gap. Across the UK, Germany, Italy, Spain and France, digital audio has over 17% share of total media consumption and yet in each market, the spend on digital audio as a percentage of telcos’ total spend in 2021 was below 0.75% – a sizable investment gap. |

|

|

Flora Williams, Head of Implementational Planning, OmniGOV Manning Gottlieb OMD, says: “Digital audio now has the capability to fit into any area of the marketing funnel. If you cross marketing KPIs (top to bottom funnel) with audience targeting (broad to niche), digital audio is able to deliver against any of these quadrants.”

Of European telcos investing in digital audio, 65% believe music streaming is more effective than other media; and 63% think podcasts are more effective. With clickable video and display as well as audio solutions, digital audio platforms are increasingly synergistic with other media channels and can help amplify campaign returns. Norman Wagner, Head of Group Media, Deutsche Telekom, says: “Audio is capable of building reach quite fast. Hence, we use podcasts, linear audio, web radio and Spotify. We see this working well in our brand tracking. Audio is also very fast at creating a sales demand. I do think the medium can work very well for brands; you just need to blend different strategies.” Deep-dives into each of the key takeaways outlined in “Getting your brand heard: Are European telcos harnessing digital audio’s full potential?” are included in the report. The study also features senior marketer views, data analysis, top findings and case studies. A complimentary copy of the report is available to download here. |